2026 feels different, but the surplus lines market still “works”. The surplus lines broker who treats this shift as a return to “shopping harder” will underperform. The broker who treats it as a maturation test will gain share.

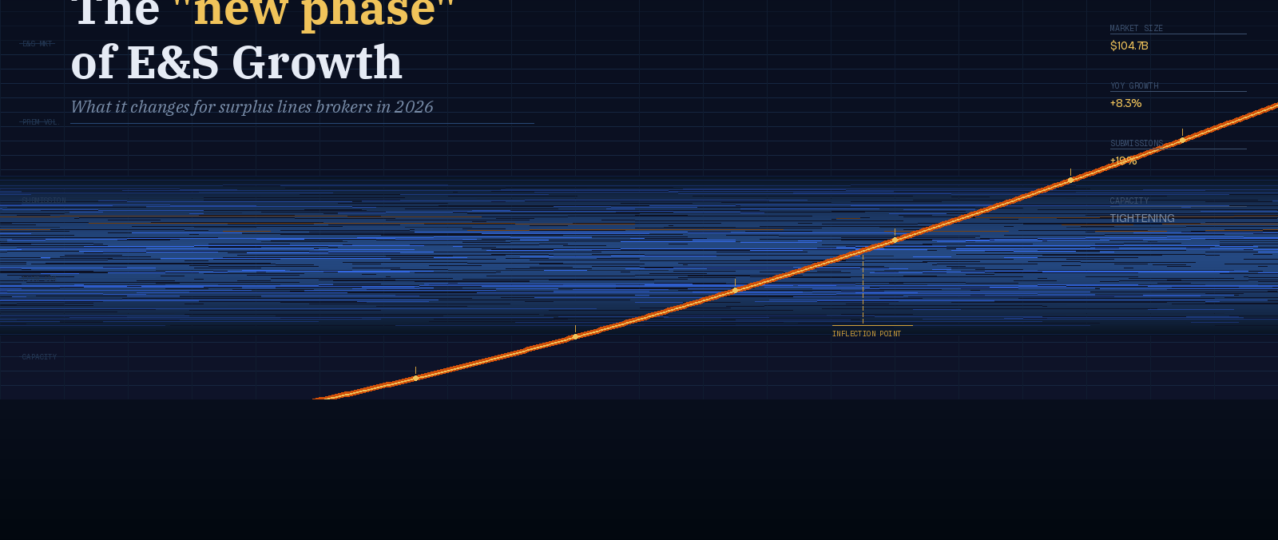

For roughly a decade, the excess and surplus segment has been defined by expansion. Capacity, premium volume, and distribution scale moved in one direction, and the dominant operational question for the surplus lines broker was execution under speed. Get the submission in shape, access the right specialty markets, and deliver a bindable solution when the admitted market could not or would not respond. In early 2026, that framing is no longer sufficient. Multiple high-quality indicators point to a structural transition in which E&S remains indispensable, but the growth regime that sustained “more business for everyone” is cooling. Swiss Re frames the moment as a “new phase” in which structural tailwinds persist while cyclical headwinds intensify, including admitted carriers reasserting selective capacity (Finucane 2026). AM Best’s market segment work and reporting show the same directional change in the data, with premium growth moderating through 2025 as competitive pressures rise in several core E&S classes (AM Best 2025; Insurance Journal 2026). Meanwhile, reinsurance renewal dynamics entering 2026 have shifted toward price declines in several property and property catastrophe layers, changing the upstream cost and attachment calculus that shapes primary market behavior, including E&S placements (S&P Global Market Intelligence 2026; S&P Global Ratings 2026).

The practical consequence is a surplus lines broker paradigm shift. In a high-growth environment, the broker’s value proposition is often summarized as market access plus responsiveness. In a moderating growth environment, the broker’s durable edge becomes underwriting literacy, data quality, coverage craftsmanship, and regulatory defensibility. The broker still needs speed, but speed becomes subordinate to precision. This essay explains the drivers of the new phase, then translates them into a 2026 playbook for surplus lines brokers who want to win in a more competitive E&S market without increasing E&O exposure.

The data signal: growth is still positive, but the slope is flattening

The most important “timely” fact is not that E&S stopped growing. It is that the growth rate is decelerating at the same time competition is increasing in lines that recently felt capacity constrained. AM Best reporting, summarized by Insurance Journal, indicates E&S premium growth increased by 9.7% through the third quarter of 2025, down from 13.5% in the comparable prior year period, citing competitive market pressures in cyber, commercial property, and directors and officers liability (Insurance Journal 2026). Swiss Re’s January 29, 2026, assessment similarly emphasizes that the slowdown is material and that admitted markets are reasserting capacity, which is a notable shift from the prior rhythm where admitted retrenchment functioned as a near-permanent “feeder” into E&S for many risk types (Finucane 2026).

This is not merely a statistical curiosity. The growth slope determines how forgiving the market is for operational friction. When premium volume is expanding rapidly, capacity providers tolerate inefficiencies: incomplete data, inconsistent narratives, weak loss runs, and uneven engineering documentation. When growth moderates, carriers and MGAs can afford to be selective, and they will redirect underwriting attention to submissions that are clean, explainable, and priced to portfolio objectives. In other words, the surplus lines broker’s competition is not only other brokers. It is also the carrier’s internal triage, which will increasingly favor accounts that arrive “ready to underwrite.”

Macro driver one: admitted markets selectively return, changing the E&S boundary

A defining theme of the last decade was the admitted market’s retreat from volatility, severity, and complex coverage. That retreat pushed a broad set of accounts into E&S. Swiss Re argues that 2026 is characterized by admitted markets reasserting capacity, meaning the boundary between admitted and nonadmitted is moving again, but not back to where it was (Finucane 2026). In practice, this does not mean the admitted market suddenly wants every difficult account. It means admitted carriers, aided by rate adequacy in certain segments and improved portfolio positioning, will compete for the best risks within categories that recently “belonged” to E&S by default.

For the surplus lines broker, that reassertion matters because it changes the placement conversation with insureds and retail agents. The broker must now justify why a risk belongs in E&S beyond “admitted declined last year.” This becomes especially important in jurisdictions where diligent search requirements remain meaningful, and where documentation of declinations is a regulatory and E&O control, not a clerical step. The NAIC Nonadmitted Insurance Model Act explicitly embeds a diligent search concept as part of the surplus lines framework, even as states vary in implementation and exemptions (NAIC 2023). When admitted capacity returns for preferred slices, regulators and plaintiffs’ counsel alike gain a clearer argument that a broker should have tested the admitted market, or at minimum, documented why the admitted market was not a realistic option.

Macro driver two: reinsurance renewal dynamics are easing in several places, but not uniformly

Reinsurance is not a mere backdrop. It is the cost of capital and volatility transfer that shapes primary carrier appetite, retention, and price discipline. Reporting around January 1, 2026, renewals indicate buyers secured price reductions again, with property catastrophe reinsurance prices likely to decline further at remaining 2026 renewal dates after double-digit declines at the January 1 renewals (S&P Global Market Intelligence 2026). S&P Global Ratings’ 2026 sector view similarly notes broad pricing declines at the January 1 renewals, most pronounced in property and property catastrophe lines (S&P Global Ratings 2026).

For E&S, reinsurance easing can create two seemingly contradictory effects at once. First, it can increase capacity and reduce marginal pricing pressure for property and property catastrophe-exposed business at the right attachment points. Second, it can intensify competition as carriers feel less constrained and are willing to compete for well-described, well-protected risks. The broker’s task becomes to position accounts so they benefit from that easing, rather than being penalized by underwriting skepticism. That is a submission and risk presentation problem, not a marketing problem. Easing reinsurance does not reduce the need for accurate construction data, defensible valuations, credible loss control, and transparent exposure narratives. It raises the reward for brokers who provide them.

Macro driver three: rate softening is emerging in select classes while casualty remains structurally pressured

AM Best’s 2026 outlook for U.S. excess and surplus lines describes slowing premium growth and early rate softening in select classes such as commercial property, while also pointing to continued pressure in casualty books and the need for stability and predictability in those portfolios (AM Best 2025). This split market matters for the broker paradigm. In property, the broker may see more quotes, more insurer interest, and more leverage on terms, but only for risks that are “clean” on data and hazard controls. In casualty and high-hazard liability, the broker should assume that underwriters remain sensitive to severity trends, limit deployment, and attachment discipline. The broker must therefore behave as a coverage engineer and risk translator, not simply as a placement intermediary.

In a split market, generic brokerage loses. Precision brokerage wins. Precision means the broker understands what the carrier is actually buying. For casualty, that includes the insured’s contractual risk transfer profile, additional insured practices, wrap-up arrangements, fleet and driver controls, and litigation venues. For property, it includes secondary modifiers such as roof age, building envelope, wildfire defensible space, mitigation features, sprinkler and alarm maintenance, business interruption dependencies, and vendor concentration. When growth slows and competition rises, underwriting becomes less tolerant of ambiguity, and ambiguity is often broker-created.

The compliance layer: NRRA, home state control, and why “defensibility” becomes strategic again

The federal Nonadmitted and Reinsurance Reform Act standardized key elements of surplus lines regulation by anchoring oversight and premium tax authority to the insured’s home state and by establishing federal standards around nonadmitted placements (Texas Comptroller of Public Accounts 2011). That framework simplified multi-state friction, but it did not eliminate compliance risk. In a new phase where admitted markets reassert capacity, the broker can expect more scrutiny of placement rationale, search documentation where required, and the suitability of coverage forms and disclosures. Stated plainly, when E&S feels less like the only option, the broker’s file must explain why E&S was the appropriate option.

This is where the broker paradigm shifts from speed to auditability. The file should tell a coherent story: the risk profile, the coverage need, why admitted capacity was not fit for purpose, what markets were approached, what declinations or restrictions were received, and why the selected nonadmitted solution was reasonable. The goal is not merely to satisfy the regulator. The goal is to remain defensible under an E&O claim framed around failure to procure appropriate coverage or failure to pursue admitted alternatives.

The 2026 surplus lines broker playbook: what changes operationally? The new phase rewards brokers who institutionalize five disciplines.

Submission hygiene becomes a competitive weapon. In a more competitive E&S landscape, underwriters respond faster and more favorably to complete, structured information. Surplus lines brokers should standardize data packages by class, include clear exposure summaries, and present loss history in a way that anticipates underwriting questions. If the broker’s package reduces underwriting labor, it increases underwriting appetite.

Broker value shifts toward risk translation and portfolio fit. When carriers are choosing among submissions, they will prefer those that align with their portfolio intent. Brokers should understand carrier and MGA underwriting strategies and should pre-qualify which market is actually aligned, instead of shopping broadly and hoping for a quote.

Wording and claims mechanics become central to placement quality. The broker must interpret triggers, definitions, sublimits, exclusions, and conditions in a way that matches the insured’s operational reality. This matters more as competition pushes price down because carriers often defend margin through terms. The broker’s job is to spot where “cheaper” is actually “narrower,” and to document the tradeoff.

Diligence and documentation should be treated as risk controls. The NAIC model framework and state implementations vary, but the principle is consistent: the broker must be able to demonstrate why the placement was appropriate within the regulatory regime (NAIC 2023). When admitted capacity returns selectively, this control becomes more important.

Broker workflows must adapt to technology and speed pressure without sacrificing quality. Commentary from market participants highlights technology and partnership as key themes for 2026, including the role of AI-enabled workflows (McKenna 2026). The surplus lines broker opportunity is to use automation to enforce standards, such as completeness checks, exposure validation, and consistent narratives, rather than using technology only to push more submissions faster.

Understand, the new phase is not a retreat; it is a maturation test

The E&S market is not disappearing. The underlying drivers that expanded E&S, including complex risks, emerging exposures, and the need for bespoke coverage, remain intact. But 2026 marks a phase shift in which growth moderates, competition rises in select classes, reinsurance dynamics evolve, and admitted markets selectively re-engage. The surplus lines broker who treats this shift as a return to “shopping harder” will underperform. The broker who treats it as a maturation test will gain share. In the new phase, the winning broker paradigm is underwriting literate, data disciplined, wording fluent, and compliance defensible. That is how surplus lines brokers will convert a cooling growth slope into durable advantage.

~ C. Constantin Poindexter Salcedo, MA, JD, CPCU, AFSB, ASLI, ARe, AINS, AIS

Bibliography

- AM Best. 2025. Market Segment Outlook: U.S. Excess & Surplus Lines. November 18, 2025.

- Finucane, James. 2026. “sigma insights 02/2026: A new phase for the U.S. surplus lines insurance market.” Swiss Re Institute. January 29, 2026.

- Insurance Journal. 2026. “E&S Premium Growth Moderates Through Nine Months of 2025.” January 30, 2026.

- McKenna, Mike. 2026. “E&S market outlook 2026: Growth, technology and partnership.” The Insurer. January 29, 2026.

- National Association of Insurance Commissioners (NAIC). 2023. Nonadmitted Insurance Model Act (Model 870). As revised for NRRA compliance.

- S&P Global Market Intelligence. 2026. “Jan. 1 renewals set stage for lower reinsurance prices in 2026.” January 29, 2026.

- S&P Global Ratings. 2026. “Global Reinsurance Sector View 2026.” February 4, 2026.

- Texas Comptroller of Public Accounts. 2011. “Guidelines for Premium Tax Compliance With the Nonadmitted and Reinsurance Reform Act.” Updated guidance page accessed February 2026.